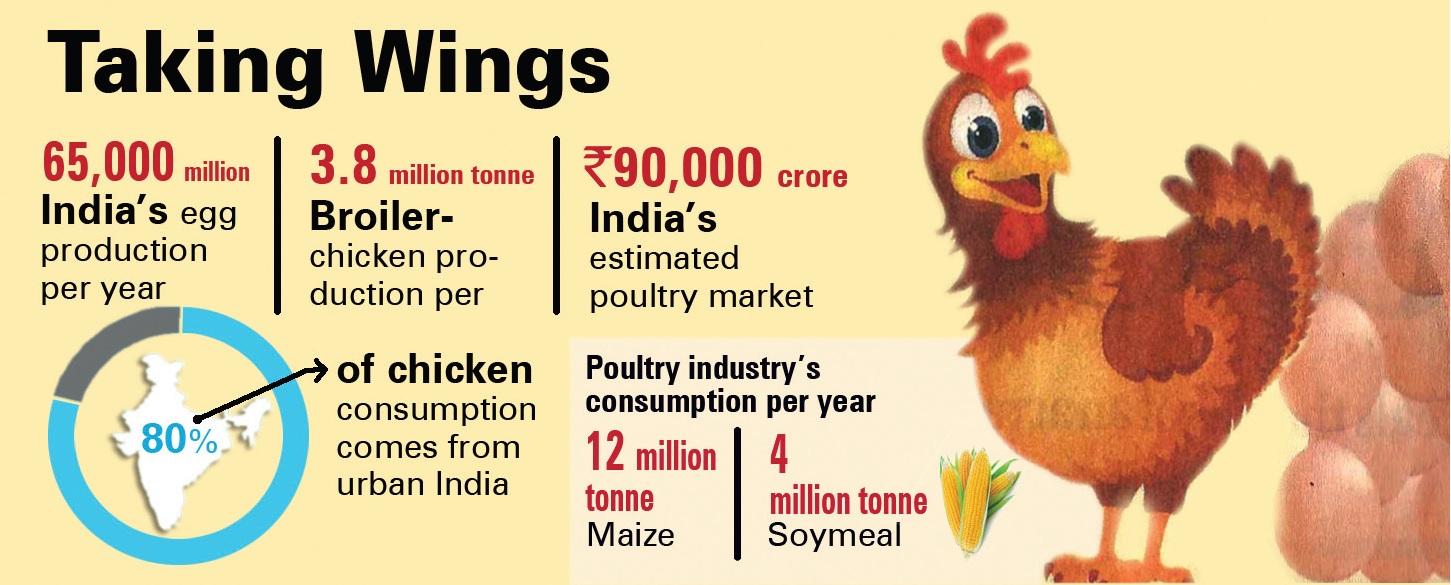

India’s poultry sector is likely to see double-digit growth in 2015 because of stable feed prices and encouraging rural demand, notwithstanding local and global challenges including a recent outbreak of bird flu and threat of chicken-leg imports from the US, say analysts and industry players.The domestic poultry sector had suffered during the past few years due to continuous increase in feedstock (mainly soya and maize) prices and oversupply of poultry products, coupled with untimely rains and drought in various parts of the country. India is the second largest egg and third largest broiler-chicken producer in the world -65,000 million eggs and 3.8 million tonne of poultry meat a year. The market is estimated to be worth about `90,000 crore. Per capita chicken consumption in India has been on the rise, with eating habits changing predominantly in the metro cities. At present, urban markets account for about 80% of demand, but analysts and industry players project rural demand to pick up significantly , thanks to lower chicken prices, improving prosperity and changing lifestyles, helping the sector post at least 8-10% expansion. Pointing out that profitability of Indian poultry sector saw significant improvement in third quarter driven by good broiler prices and softer feed prices, analysts at Rabobank said the current price of `50-70 per kg for live birds should trigger better demand among rural population. “Improved demand and lower feed costs hold promising prospects for the industry in the near term,“ Rabobank said in a recent report. India’s soymeal prices are above global rates, making exports challenging. That should keep domestic prices under check, said the Rabobank report. It expects local maize prices to stay at lower levels. Annually, the domestic poultry industry consumes around 12 million tonne of maize and 4 million tonne of soymeal. Together, these account for some 85% of total poultry feedstock. Kailash Gandhi, MD of KRG Strategy Consultants, which tracks the agriculture and allied sectors, said the poultry sector suffered losses over the past two years, largely due to an abnormal increase in input costs. Poultry farmers could not pass on the burden to consumers owing to muted demand, he said. “Further, in spite of the industry resorting to hatching holidays often last year to contain supplies, there was oversupply that led to pressure on broiler prices. Given the positive trends of rural demand pickup and stable input costs, we now expect the industry to see some 8-9% growth next year.“ (Source: The Economic Times, Mumbai, December 25, 2014)

Disclaimer: The information provided within this publication / eBook/ content is for general informational purposes only. While we try to keep the information up-to-date and correct, there are no representations or warranties, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the information, products, services, or related graphics contained in this publication / eBook/ content for any purpose. Any use of this information is at your own risk.

Youth

Youth

Women

Women

Research for Ishrae

Research for Ishrae